Content Spotlight

Curry House Japanese Curry and Spaghetti has shuttered, closing all 9 units in Southern California

Employees learned of closure when arriving for work Monday

• See more Consumer Trends

Although the foodservice traffic numbers from The NPD Group show the latest quarter ending in June only matches the 2009 level of 15.7 billion for the same period, there are plenty of positives: U.S. restaurant traffic improved just one percent in year-over-year comparisons, but consumer spending gained three percent because of higher check averages.

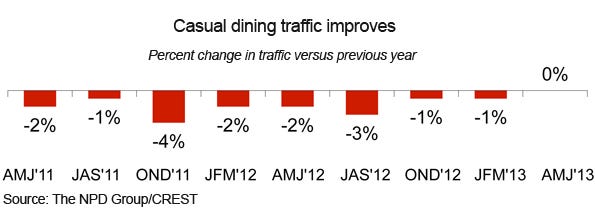

Even better, the casual dining segment, which represents 10 percent of all industry traffic, stopped its free fall. It was only flat, but that is marked improvement over quarterly declines dating all the way to the second quarter of 2008.

“There were several bright spots in the industry in the second quarter, and certainly casual dining ending its cycle of traffic losses is one of them,” says Bonnie Riggs, NPD restaurant industry analyst. “Any gain in the current market is good news and keeps the industry steady.”

Quick-service restaurants, 78 percent of industry traffic, remained steady by gaining one percent, thanks to the fast-casual segment that falls under QSR and grew eight percent. Fine dining and upscale hotel restaurants were up six percent, but the segment makes up just one percent of industry traffic.

The midscale and family dining segment continued to take the biggest hit, losing two percent for the fourth straight quarter. Other nuggets of note:

• Breakfast/morning meals saw three percent traffic growth, while lunch and dinner remained flat.

• Afternoon snacking saw a one percent increase in visits.

• Deal traffic, with a check average of $6.15 and 23 percent of industry traffic, gained five percent this quarter after increasing four percent the prior quarter. Not surprisingly, non-deal traffic, with a check average of $7.17, fell one percent.

You May Also Like